IQ Option India

IQ Option is a leading international online trading platform that has also gained substantial popularity in India. It provides users with the opportunity to trade a wide variety of financial instruments, including stocks, commodities, and cryptocurrencies. The platform is known for its user-friendly interface, comprehensive educational resources, and advanced trading tools, making it suitable for both beginners and experienced traders. IQ Option also offers a free demo account for users to practice their trading strategies before investing real money. It is fully regulated and adheres to the strict financial standards and security measures, ensuring a safe and secure trading environment for its users in India. In this IQ Option review India, we will learn more of the platform’s features, advantages, and more.

How to Get Started with IQ Option India

Getting started with IQ Option in India is fairly straightforward. First, you need to visit the website or download the IQ Option app from the Google Play Store or Apple App Store. Once downloaded, you should create an account by providing your details such as name, email address, and phone number. After successful registration, you need to deposit a minimum amount to start trading. IQ Option provides various deposit methods including credit or debit cards, e-wallets like Skrill, Neteller, and even wire transfers. Once the deposit is made, you can start exploring various trading options such as binary options, stock CFDs, and forex. It is important to remember that trading involves risk and hence it’s advisable to gain a good understanding of the platform and market trends before getting started.

IQ Option Account Types

IQ Option is a top-rated broker known for its simplicity and easy-to-use features that have gained popularity among traders worldwide. The broker offers several types of trading accounts to cater to the unique needs of different traders. Here is a review of the different account types offered by IQ Option:

- Demo Account: The IQ Option demo account is available for beginners or those who wish to practice trading without risking any real money. The demo account comes with $10,000 in virtual cash, which can be replenished if it runs out. This account type is an excellent way for new traders to learn the ropes and gain confidence before moving on to real trading.

- Real Account: The real account at IQ Option requires a minimum deposit of $10. With this account, traders have access to over 70 assets to trade in, including stocks, commodities, cryptocurrencies, and indices. The account offers full access to trading opportunities and functions, and withdrawals can be made within 24 hours.

- VIP Account: The VIP account at IQ Option is for professional traders and requires a minimum deposit of a significant amount. The VIP account comes with a range of additional benefits, including a personal account manager, higher profitability rates, and free participation in trading competitions.

- Islamic Account: IQ Option Islamic account complies with the principles of Islamic law (Sharia law). This account type does not involve any swap or rollover charges on overnight positions, and it’s open for traders who follow the Islamic faith.

Tradeable Assets

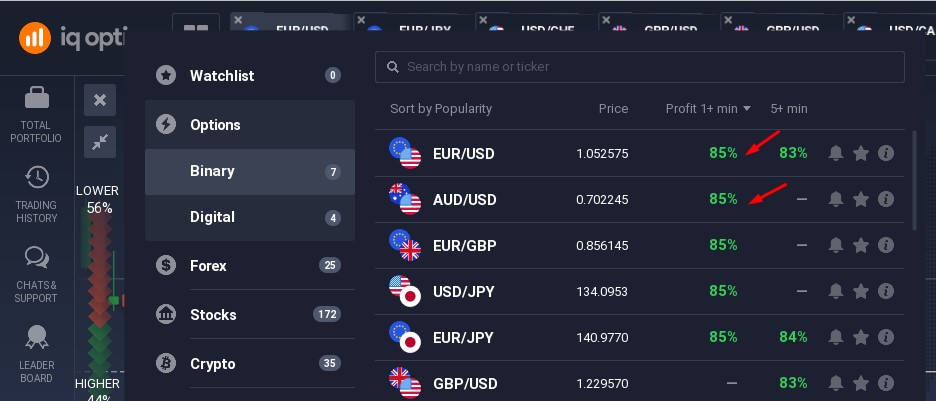

IQ Option allows users to trade in various financial instruments. In India, IQ Option allows trading in a wide range of assets. Here are the assets you can trade on IQ Option in India:

- Forex: IQ Option offers the opportunity to trade on over 188 currency trading pairs. This includes major pairs like USD/EUR, minor pairs, and exotic pairs.

- Stocks: You can trade on the stocks of several multinational companies worldwide, including tech giants like Google, Amazon, and Facebook.

- Cryptocurrencies: IQ Option allows trading in a variety of cryptocurrencies including Bitcoin, Ethereum, Ripple, and others.

- Commodities: Commodities like gold, silver, crude oil, and others are also available for trading on IQ Option.

- ETFs: Exchange-Traded Funds (ETFs) are a type of investment fund and exchange-traded product that aims to track the performance of a specific index. ETF trading is also available on IQ Option.

- Indices: Indices such as S&P 500, Nasdaq, Dow Jones, and others can also be traded on IQ Option.

- Options: IQ Option also offers binary options trading where you can earn profits by predicting the future price of an asset.

Please note that the availability of these assets may vary depending on market conditions and regulations. Always ensure you understand the risks involved in trading these assets and seek advice if necessary.

IQ Option Deposit and Withdrawal

How to Deposit into IQ Option Account in India?

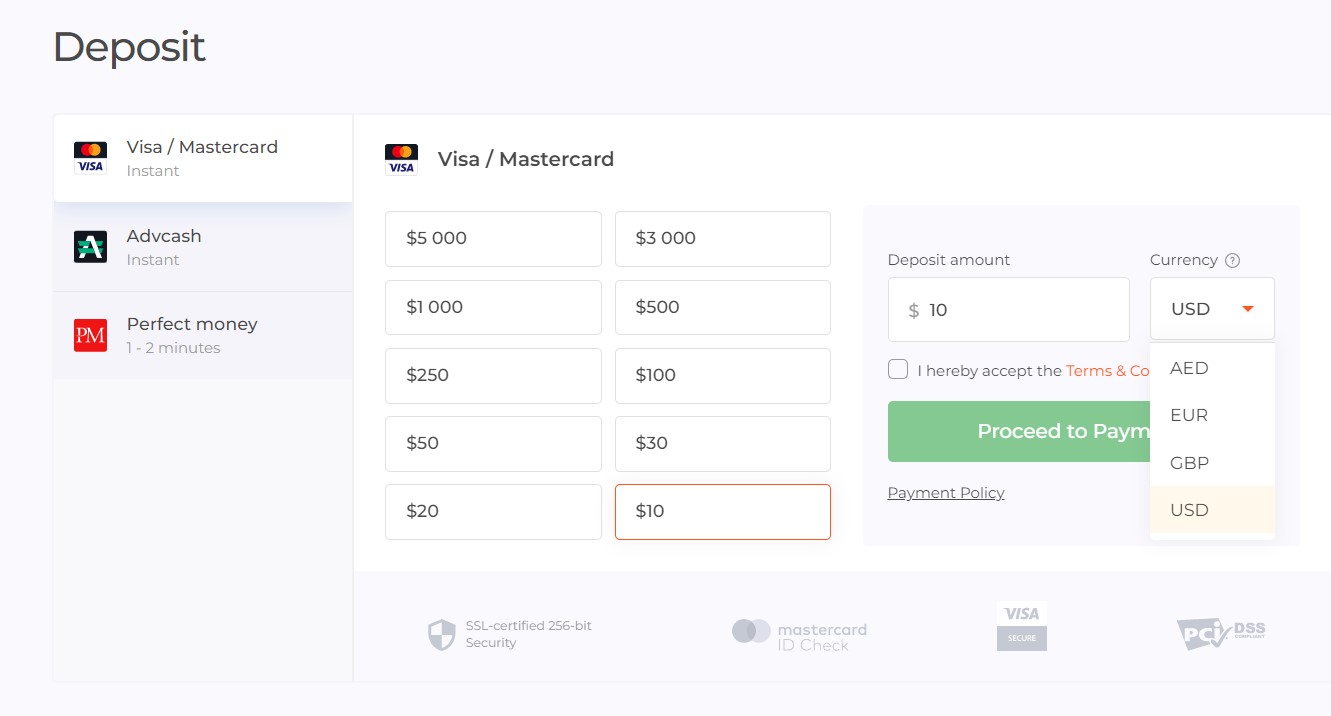

If you’re in India and want to deposit money into your IQ Option account, there are several options available to you.

- Credit/Debit Card: This is the most common method of depositing funds. IQ Option accepts both Visa and MasterCard. The funds are usually available instantly.

- E-Wallets: IQ Option also allows deposits via various e-wallets like Skrill, Neteller, and WebMoney. Indian customers can also use AstroPay Card and AdvCash.

- Wire Transfer: You can also transfer money directly from your bank account to your IQ Option account. However, this could take a few days for the funds to be available in your account.

- Cryptocurrencies: IQ Option also accepts deposits in the form of cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Remember, the IQ Option minimum deposit amount is $10 (USD). It’s also important to know that some banks may charge a small fee for these transactions. Before choosing a deposit method, check the terms and conditions and make sure you’re comfortable with any fees or other requirements.

IQ Option Withdrawal Methods

IQ Option is very popular in India and offers an efficient withdrawal process for its Indian users.

- Bank Wire Transfer: This is a conventional mode of money transfer that all account holders can use. Bank wire transfers may take up to 10 business days.

- Credit/Debit cards: IQ Option permits withdrawals via VISA and MasterCard. The process may take up to 3 business days.

- E-Wallets: The platform supports a range of e-wallets such as Neteller, Skrill, WebMoney, and others. This option is very popular because of its speed and convenience. The processing time for e-wallets usually takes within 24 hours.

- Cryptocurrencies: Withdrawing using cryptocurrencies is also available, although the transaction time may based on the specific blockchain network.

The IQ Option minimum withdrawal amount in India is $2. However, if you are using the bank wire transfer method, the minimum amount rises to $50. IQ Option does not charge any fees for withdrawal requests. However, it should be noted that your bank or e-wallet provider might charge a fee for processing the transaction.

Please note that IQ Option requires you to withdraw funds using the same method that you used to deposit them. Also, you might need to verify your identity before withdrawing, which is a standard procedure to prevent fraudulent activities.

Exploring IQ Option’s Trading Platforms in India

Here’s a list of trading platforms provided by IQ Option for users in India:

- Web Trading Platform: Accessible via any web browser without the need for downloading or installing anything. It offers a user-friendly interface, multiple chart layouts, various analytical tools, and historical quotes.

- Desktop Trading Platform: An application available for both Windows and Mac OS users. It includes all features of the web trading platform along with added benefits like easy multitasking, faster execution, and auto-updates.

- Mobile Trading Platform: A mobile application available for both iOS and Android devices, allowing trading on the go. It enables traders to monitor their trades, analyze markets, and execute trades anytime, anywhere.

- IQ Option API: For advanced traders, the API (Application Programming Interface) can be used to create automated trading systems or integrate IQ Option’s trading services with existing trading applications.

The IQ Option download link can be found on the official website of the broker.

Technical Indicators and Tools on IQ Option Platform India

- Moving Averages (MA): This is a popular tool used to identify price trends over a specific period. Moving averages help to smooth out price data to create a line that traders can use to predict future price movements.

- Bollinger Bands: This tool uses a set of trendlines to plot the volatility of an asset’s price. The bands widen during periods of increased volatility and narrow during less volatile periods.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements to help traders identify overbought or oversold conditions.

- Stochastic Oscillator: This is another momentum indicator that compares a particular closing price of an asset to a range of its prices over a certain period.

- Average True Range (ATR): This technical indicator measures market volatility by decomposing the entire range of an asset price for that period.

- Moving Average Convergence Divergence (MACD): This trend-following momentum indicator shows the relationship between two moving averages of a security’s price.

- Parabolic SAR (Stop and Reverse): This indicator provides potential entry and exit points. It appears as a dotted line on the chart. When the dots are below the price, it indicates a bull market. When the dots are above the price, it indicates a bear market.

- Awesome Oscillator: This indicator is used to confirm trends and determine possible reversal points. It reflects market momentum and is often used in conjunction with other indicators.

- Ichimoku Cloud: This tool provides an overview of the market at a glance. It helps traders understand the current market condition, the direction of the trend, and potential support and resistance levels.

- Alligator Indicator: This tool helps traders confirm the presence of a trend and its direction. It consists of three lines: the lips, teeth, and jaws of the alligator.

IQ Option India – How to Get Verified?

To get verified on IQ Option in India, you need to submit certain documents for identity verification. This process involves uploading a clear, color copy of a valid government-issued ID, such as a driver’s license, passport, or Aadhaar card. In addition to this, you may also need to provide proof of address, which could be a utility bill or bank statement not more than three months old. The verification process is crucial as it ensures the safety of your transactions and complies with international anti-money laundering regulations. Please note that the process may take a few days to complete, and once verified, you will receive a confirmation email from IQ Option.

Education Resources

- Trading Tutorials: These are step-by-step guides that provide in-depth instructions on how to use the platform and make trades. They can be beneficial for both beginners and experienced traders who want to understand the platform’s full capabilities.

- Webinars: Webinars are live online seminars where you can learn from experienced traders and industry experts. They often cover various topics, from basic trading principles to advanced strategies. You can also ask questions and interact with the speakers.

- Blog: IQ Option maintains a regularly updated blog that features articles on a wide range of topics, including market insights, trading strategies, and platform updates. It’s a useful resource to stay informed about the latest trends and news in the trading world.

- Video Tutorials: These are short videos that explain various trading concepts and strategies clearly and concisely. They can be beneficial if you’re a visual learner.

- FAQ Section: This section answers the most frequently asked questions about trading on IQ Option. It covers a wide range of topics, from account setup and trading basics to more technical aspects of the platform.

- E-books: IQ Option provides a collection of e-books that delve into various trading topics. These can be downloaded and read at your own pace, making them a great resource for learning more about trading at your convenience.

- Interactive Courses: These are structured lessons that guide you through various trading topics. They often include interactive elements like quizzes and exercises to help reinforce what you’ve learned.

- Market News: This is a regularly updated news feed that keeps you informed about the latest developments in the financial markets. It can help you stay on top of market trends and make more informed trading decisions.

IQ Option India – Customer Support

IQ Option offers efficient customer support services in India. Indian users can benefit from their dedicated 24/7 customer support to resolve any queries or issues related to trading. The support team can be reached through multiple channels such as live chat, email, or phone calls. They are well-equipped to handle a wide range of issues, from technical difficulties to account-related queries. Notably, the customer support team is known for its prompt responses and professional service, ensuring that users have a seamless trading experience.

Is IQ Option Legal in India?

IQ Option is a digital trading platform that is indeed legal in India, as there are no specific laws or regulations prohibiting the use of such platforms in the country. IQ Option broker offers a variety of trading options, including stocks, forex, cryptocurrencies, and other financial instruments. However, while the platform itself is legal, it is essential for users to comply with India’s tax laws and regulations regarding income generated from trading. Therefore, potential traders should seek advice from financial or legal experts before engaging in such activities. Is IQ Option legit? Yes, it a legitimate binary options broker.

IQ Option is real or fake?

IQ Option broker is a 100% real online trading platform that offers services in various markets, including India. It is regulated and is recognized as a trustworthy broker in the trading industry. However, it’s essential to note that while IQ Option itself is not a scam, online trading does involve substantial risk, and potential traders should thoroughly research and understand these risks before participating.

IQ Option India Review – Conclusion

In conclusion, IQ Option is a popular online trading platform globally and it also has a significant presence in India. It offers a wide range of financial instruments to trade in, including stocks, forex, and cryptocurrencies. Despite the regulatory uncertainties and debates around online trading in India, IQ Option continues to be a preferred choice for many due to its user-friendly interface, educational resources, and customer support. However, potential users in India should ensure they thoroughly understand the platform, its legality, and the risks involved in trading before they start using IQ Option. Is IQ Option safe? Yes, it is safe to trade with this reliable online trading platform.

IQ Option trading is expected to witness significant growth in India in the future. India’s rapidly expanding middle class, increasing internet penetration, and a burgeoning interest in investment products are factors contributing to this prediction. Furthermore, the platform’s user-friendly interface, educational resources, and diverse trading options make it appealing to both novice and experienced traders. However, the future growth of IQ Option India largely depends on the regulatory landscape, as online trading platforms have faced scrutiny and legal challenges in the country. If the platform can navigate these challenges and adapt to any regulatory changes, it is poised for considerable expansion in the Indian market.