Forex Trading in India

What is Forex Trading?

Forex trading, also known as foreign exchange trading or currency trading, is the act of buying and selling currencies. This is done in the forex market, which is a global decentralized or over-the-counter market for the trading of currencies. It is the largest and most liquid market in the world, with an average daily trading volume exceeding $5 trillion. Traders engage in forex trading in order to profit from the changes in the value of one currency against another. These transactions occur in pairs, such as EUR/USD or USD/JPY. The forex market is open 24 hours a day, five days a week, making it accessible for traders around the globe.

Forex trading in India refers to the trading of foreign currencies in the Indian market. It is facilitated by the Foreign Exchange Market, where currencies from different countries are exchanged, bought, or sold. In India, the forex market is regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Individuals, companies, and banks can engage in forex trading, but they must adhere to the rules and regulations set by these governing bodies. Forex trading in India has gained significant popularity over the years due to its potential for substantial returns. However, it also carries a high risk due to the volatile nature of currency exchange rates.

In addition to regular Forex trading, more traders in India are going for Forex Copy Trading and Forex Managed Accounts. Investing through Forex Copy trading and Forex-managed accounts in India is simpler than self-trading. There are experts in the field of Forex trading who trade for you in a managed Forex account, so your chances of success in better. In Forex copy trading, you copy the trades of an expert Forex trader automatically in your account and get results similar to the expert trader you are following. Get the finest collection of strategy providers with FXTM Invest for Forex copy trading in India.

How to get started with Forex Trading in India

- Understand the Basics: Before diving into forex trading, it’s crucial to understand the basics. Learn about currency pairs, pips, leverage, margin, and how forex markets operate. Also, understand the risks involved in forex trading.

- Learn the Regulations: In India, forex trading is regulated by the Reserve Bank of India (RBI) and the Securities Exchange Board of India (SEBI).

- Choose a Reliable Forex Broker: Always choose a Forex broker registered with SEBI. They should provide a secure trading platform, competitive spreads, swift execution of orders, and excellent customer support.

- Open a Forex Trading Account: You will need to provide identification documents, proof of address, and bank account details. After your account is verified, you can fund it and start trading.

- Learn to Analyze the Market: There are two main types of market analysis – fundamental and technical. Fundamental analysis involves evaluating economic indicators, political developments, and social factors. Technical analysis involves studying price charts and using technical indicators.

- Develop a Trading Strategy: A trading strategy will guide your trading decisions. It will define when to enter and exit trades, how much to risk per trade, and how to manage your trading capital. There are many trading strategies available online, but it’s best to develop one that suits your trading style and risk tolerance.

- Start Practicing: Most forex brokers offer demo accounts where you can practice trading with virtual money. This is a great way to gain experience and test your trading strategy without risking real money.

- Start Trading: Once you feel confident, you can start trading with real money. Always start small and gradually increase your trading size as you gain more experience and confidence.

- Keep Learning and Improving: Forex trading is a continuous learning process. Always keep track of your trades, review your performance, and look for ways to improve.

Recommended Best Forex Trading Platforms in India

In choosing a reliable forex broker, several key factors should be taken into consideration. Firstly, regulation and security are paramount. It is essential to ensure that the broker is regulated by a reputable financial authority to guarantee the safety of your investment. Secondly, the cost of transactions, which includes spreads and commissions, must be considered. Lower costs are preferable for higher profitability. Thirdly, the trading platform’s user interface should be user-friendly, stable, and equipped with essential trading features. Fourthly, the broker’s customer service should be efficient and responsive to quickly resolve any issues that may arise. Lastly, the speed and ease of deposits and withdrawals are also essential, ensuring smooth transactions without unnecessary delays.

Exness India

Exness India is a branch of the international forex trading company, Exness. Established in 2008, Exness has grown to become a leading player in the global forex market, providing financial services to traders in more than 120 countries, including India. The company is renowned for its advanced trading platforms, competitive spreads, and exceptional customer service. In India, Exness offers a secure and user-friendly trading experience for both novice and experienced traders. The company is also committed to maintaining the highest standards of regulatory compliance and transparency, ensuring that customers can trade with confidence and peace of mind. Check out our Exness review here.

Is Exness legal in India? – Exness, a forex trading broker, operates legally in India.

FBS Forex India

FBS Forex broker is a well-known platform in India, widely used for Forex trading. Its user-friendly interface and diverse trading tools have contributed to its popularity. FBS provides the opportunity to trade in different financial markets such as Forex, stocks, and commodities. With various account types, it caters to the needs of both beginner and experienced traders. FBS also offers extensive educational resources and round-the-clock customer support to help traders throughout their trading journey. The broker’s transparent business practices and strict compliance with regulatory standards further enhance its reputation among Indian traders. Check out our FBS in India review here.

Is FBS legal in India? – FBS Forex broker is a legal and recognized financial trading platform in India, overseen by global financial regulatory bodies. It provides a safe trading environment for Indian traders, making it a suitable option for forex trading. However, traders should always adhere to local laws and regulations.

easyMarkets India

EasyMarkets is a global online trading platform that has expanded its operations to India as well. It provides Indian traders with access to global markets and a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies. EasyMarkets offers innovative trading technologies and services such as free guaranteed stop loss, insideViewer, Freeze Rate, and dealCancellation. With a user-friendly interface and robust customer support, it has become popular among both novice and experienced traders in India. Moreover, it ensures a safe and secure trading environment with its strong regulatory framework and compliance with international standards. Read our easyMarkets in India review here.

AvaTrade India

AvaTrade has expanded its operations to India, providing Indian traders with a platform to trade various financial instruments. AvaTrade offers a broad range of trading services including Forex, commodities, indices, stocks, bonds, and cryptocurrencies. The platform is renowned for its user-friendly interface, advanced trading tools, and educational resources that cater to both novice and experienced traders. In India, AvaTrade operates under strict regulatory standards, ensuring a secure and transparent trading environment for its clients. The platform’s presence in India not only diversifies the country’s financial market but also provides local traders with global trading opportunities.

Is AvaTrade legal in India? – AvaTrade forex trading platform, is legally permitted to operate in India.

Eightcap India

Eightcap is an established forex broker operating in India, providing traders with access to the global forex market. This Australian-based brokerage firm offers a secure platform for trading various financial instruments, including Forex and CFDs. It is regulated by the Australian Securities and Investments Commission (ASIC), ensuring a trustworthy and transparent trading environment. Eightcap offers competitive spreads, fast execution, and a choice between the MetaTrader 4 and MetaTrader 5 platforms, making it a preferred choice for many traders in India. It also provides educational resources for beginners and advanced traders, enhancing their trading skills and knowledge.

Is Eightcap legal in India? – The Eightcap broker is legally permitted to operate in India.

FxPro India

FxPro broker is a renowned online forex broker that offers trading services to clients in India. They provide a robust and reliable platform for trading in various financial instruments such as forex, futures, indices, and shares. FxPro’s commitment to providing high-quality service and its adherence to stringent regulatory standards have made it a preferred choice for many traders in India. It offers advanced trading tools, competitive spreads, and excellent customer service. Furthermore, FxPro provides a range of educational resources to help traders understand financial markets better and make informed trading decisions.

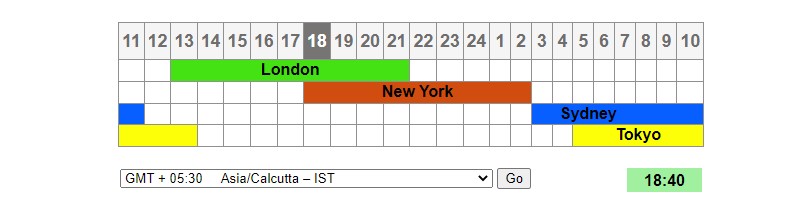

Forex Trading Time in India

Forex trading time in India is dictated by international market hours, which operate 24 hours a day as it involves global currency trade. The market opens on Monday morning Australian time and closes on Friday evening New York time. It is divided into four major sessions: the Sydney session, the Tokyo session, the London session, and the New York session. Indian traders can trade Forex from Monday to Friday, 24 hours a day, with the most significant trading volume observed during the overlap of London and New York sessions. In Indian Standard Time, the market opens at 3:30 AM and closes at 3:30 AM the next day. However, the most active trading hours, when the volatility is highest, are from 12:30 PM to 3:30 PM.

Forex Mobile Trading: Forex Trading Apps in India

Forex mobile trading in India has seen a steady rise with the advent of forex trading apps. These applications have revolutionized forex trading, making it accessible and convenient for traders across the country. They allow users to trade in real-time, monitor market trends, and make informed decisions on the go. Several forex trading apps in India offer a range of features including interactive charts, advanced analytical tools, and news updates to assist traders in making profitable trades. These apps have made forex trading a more user-friendly and efficient process, contributing to its growing popularity among Indian traders. Some of the popular and best forex trading apps in India are Exness, easyMarkets, FBS, AvaTrade, FxPro, and Eightcap.

Is Forex Trading Legal in India?

Forex trading is indeed legal in India, but it comes with several restrictions and regulations. The Reserve Bank of India (RBI) and the Securities Exchange Board of India (SEBI) are the two main governing bodies that oversee Forex trading in the country. They allow trading only in certain pairs of currencies, such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. However, it’s essential to note that while Forex trading is legal, it’s not permissible to trade in all types of foreign currencies. Also, Indian Forex traders must use an Indian Forex trading platform or an SEBI registered Forex broker for their transactions. Therefore, despite being legal, Forex trading in India is highly regulated to ensure that it’s conducted within the boundaries of the law.

Income Tax Implications for Forex Trading in India

Forex trading in India has certain income tax implications. According to the Income Tax Act 1961, any income generated from Forex trading is taxable and needs to be declared while filing income tax returns. The tax rate varies based on the nature of the income, whether it’s speculative or non-speculative. Speculative income from Forex trading is taxed at the normal slab rates applicable to an individual. However, non-speculative income is treated as business income and taxed at a flat rate of 30%. It is essential for Forex traders in India to maintain a proper record of their transactions to calculate their tax liabilities accurately. Also, note that the penalties for non-disclosure or inaccurate disclosure can be severe.

Forex trading Strategies

- Breakout Strategy: A breakout is when the market moves beyond the boundaries of its consolidation, to new highs or lows. Once a new trend happens, a breakout must happen first. Traders set up their trades based on this breakout.

- Moving Averages Strategy: Traders use moving averages (MA) to identify trends, entries, and exit points to capture profits.

- The Carry Trade: This involves borrowing a low-interest-rate currency and using the funds to purchase a high-interest-rate currency. The difference between the interest rates is the trader’s profit. This strategy is more suitable for long-term traders.

- Scalping: This involves making many trades within a day for small profits. It requires a lot of time and concentration. Scalpers aim to make small profits while exposing their accounts to a minimal risk.

- Swing Trading: Swing traders aim to capture the quick movements of the market. They hold their trade for more than a day but not longer than a week to catch a major price movement.

- Trend Trading: This strategy involves identifying the market’s direction – up or down – and trading in that direction. Traders use various tools and analysis techniques to determine the trend.

- Position Trading: This long-term strategy involves holding trades for several weeks, months, or even years. Position traders rely on fundamental analysis and pay less attention to short-term market fluctuations and technical indicators.

- Day Trading: Day traders do not hold their positions overnight and aim to profit from short-term daily price fluctuations.

- Price Action Trading: This strategy involves the study of past prices to formulate technical trading strategies. Price action can be used as a stand-alone technique or in conjunction with an indicator.

- Range Trading: Traders identify currency pairs that are moving sideways, and they buy at the lower level (support) and sell at the upper level (resistance).

Forex trading in India – Conclusion

In conclusion, Forex trading in India has gained significant popularity over recent years due to its potential for high returns. Despite the stringent regulations imposed by the Reserve Bank of India, many traders have found ways to engage in forex trading, using authorized brokers and following the prescribed guidelines. However, it carries substantial risks alongside its potential for significant profits. Therefore, prospective traders must undertake comprehensive research, education, and risk management strategies before diving into it. The future of forex trading in India looks promising, but it requires the government’s further support to become a thriving and legally acknowledged trading environment.